Media komunikasi dan kolaborasi pembelajaran a'la virtual. Supplemen kuliah melalui e-class atau e-learning untuk Jurusan terkait dengan Sistem Informasi, Teknologi Informasi (IS/IT), Sistem Komputer dan Teknik Industri.

Monday, March 23, 2015

Rakuten .. again

Europe smart meters projection

Saturday, March 21, 2015

Rakuten Corporate Action

Lyft Inc $530 million

Ebates Inc $981 million : October 2014

Viber Media $905 (or $900?) million : March 2014 : mobile chat and app platform provider

Wuaki.tv

Viki Inc

Kobo Inc. $350 (or $315?) million : ? 2012 : e-reader and e-book provider

Play.com $39 million : 2011 : U.K. e-commerce operator

Tradoria 80% stake : 2011: e-commerce platform

PriceMinister $248 million : 2010 : France-based e-commerce operator

Total $3.2 billion

-------------------------------------------------------------------------------------------------------------------------

From internetretailer.com 's article

Rakuten pays $410 million for U.S. e-book marketplace OverDrive

March 19, 2015 by BLOOMBERG NEWS

-------------------------------------------------------------------------------------------------------------------------

Japan’s Rakuten buys U.S. rebate site Ebates for $1 billion

September 9, 2014 by BLOOMBERG NEWS

-------------------------------------------------------------------------------------------------------------------------

Rakuten buys mobile messaging company Viber for $900 million

February 14, 2014 by AMY DUSTO Associate Editor

Viber allows members to chat and talk for free on mobile, as well as purchase and send each other digital stickers. Rakuten’s CEO says it has “tremendous potential” to become a gaming platform, too.

-------------------------------------------------------------------------------------------------------------------------

Japan’s Rakuten to buy U.K.-based online retailer Play.com

September 21, 2011 by Thad Rueter

The acquisition marks the latest global e-commerce investment for the owner of Buy.com

Japan-based Rakuten Inc. today said it will buy U.K. e-commerce operator Play.com for 25 million pounds (US$39 million).

The acquisition of the retailer, which sells music, DVDs, books, consumer electronics, office equipment, mobile phones, toys and other products, marks the latest global e-commerce investment by Rakuten, which in 2010 bought U.S. e-retailer Buy.com Inc.

Play.com, No. 26 in the Internet Retailer Europe 300 Guide, had online sales of $660 million last year, up 18% from the year before. Buy.com is No. 32 in the Internet Retailer Top 500 Guide.

“The U.K. market is one of Europe’s largest and most mature e-commerce markets. Play.com is not only a pioneer in the market, but also one of the U.K.’s most successful e-commerce businesses,” says Hiroshi Mikitani, chairman and CEO of the Japan-based e-marketplace operator. “We aim to leverage our e-commerce strength and experience to further expand and develop Play.com’s business model and channel its loyal user base, merchants, and deep product offerings into Rakuten’s global e-commerce network.”

Rakuten says it will buy up all of Play.com’s stock.

Earlier this month, Rakuten was part of a group of investors that raised $100 million for Russia-based online retailer Ozon.ru, which, like Play.com, sells a wide variety of products. The investment followed Rakuten’s purchases in June of a 75% stake in Brazil-based Ikeda, which sells e-commerce technology and services to more than 100 of the largest online retailers in that country. Rakuten this year also acquired 80% of Germany-based Tradoria GmbH, which sells an e-commerce platform. In 2010, Rakuten bought France-based e-commerce operator PriceMinister.

Thursday, March 19, 2015

Asia Pacific (excl Japan) Online Game Market Projection

Online gaming in APAC to breach $30B in 4 years

Sunday, March 15, 2015

Success recipe

Take from Business Insider

50 Universal Truths That Will Make You More Successful

by JULIE BORT OCT. 28, 2013

No matter what is going on in your career, good advice is universal. No matter what problems you are trying to solve, chances are someone else before you had a similar problem.

There are certain universal "business truths" — tips and tricks that work for nearly everyone in every business. They are:

1. Have a passion for your work. If your work is meaningful to you, your work life will be a joy.

2. If you can't be passiona7te about the work itself, be passionate about the reason you do it. Maybe you don't love your job or company or career, but the money and benefits are good for your family. Be passionate in your choice to do right by your family.

3. If something needs changing, be the one to lead the change. If you dislike your job but are stuck, work on getting the skills that will get you unstuck. If there's a problem at your office, work on being the one solve it.

4. Start small and build from there.

5. Do the obvious stuff first, then progress to the harder stuff. (Otherwise known as going for the low-hanging fruit.)

6. If it's not broke, don't fix it. Do improve it.

7. The hardest lesson to learn is when to keep going and when to quit. No one can teach you that. At some point, you have to choose.

8. The definition of crazy is to do the same thing the same way and expect a different result. If the result isn't good, change something.

9. No one succeeds alone.

10. Ask for help. Be specific when asking. Be graceful and grateful when help comes.

11. Surround yourself with positive people and you'll have a positive outcome.

12. Embrace diversity. The best way to compensate for your own weaknesses is to pick teammates who have different strengths.

13. People experience the world differently. Two people can attend the same meeting and walk away with different impressions. Don't fight that. Use it.

14. You don't have to like someone to treat that person with respect and courtesy.

15. Don't "should" all over someone, and don't let someone else "should" all over you.

16. No matter what you do or how much you achieve, there are always people who have more.

17. There will always people who have less, too.

18. No matter how much you excel at things, you are not a more worthwhile human being than anyone else. No one else is more worthwhile than you, either.

19. If you spend most of your time using your talents and doing things you are good at, you're more likely to be happy.

20. If you spend most of your time struggling to improve your weaknesses, you're likely to be frustrated.

21. Practice is the only true way to master a new skill. Be patient with yourself while you learn something new.

22. The only way to stay fresh is to keep learning new things.

23. To learn new things means being a beginner, and that means making mistakes.

24. The more comfortable you grow with making beginner mistakes, the easier it is to learn new things.

25. You will never have all the resources (time, money, people, etc.) that you want for your project or company. No one ever has all the resources they want.

26. A lack of resources isn't an excuse. It's a blessing in disguise. You'll have to get creative.

27. Creativity and innovation are skills that can be learned and practiced by doing your usual things in a new way.

28. Take calculated risks.

29. In the early stages of a company, career, or project, you'll have to say "yes" to a lot of things. In the later stages, you'll have to say "no."

30. Negative feedback is necessary. Don't automatically reject it. Examine it for the nuggets of truth, and then disregard the rest.

31. When delivering criticism, talk about the work, not the person.

32. Think big. Dream big. (The alternative is to think small, dream small.)

33. Treat your dream as an ultimate roadmap. You don't have to achieve your dream right away, but the only way to get there is to take many steps toward it.

34. If you think big, you will hear "no" more than you hear "yes." They don't get to decide. You do.

35. How long it takes you to create something is less important than how valuable and worthwhile it will be once it's created.

36. If there is one secret to success, it's this: communicate your plans with other people and keep communicating those plans.

37. Grow your network. Make an effort to meet new people and to keep in contact with those you know.

38. No matter what technology or service you are creating or inventing at your company, it's not about the product; it's always about the people and the lives you will improve.

39. No matter how successful you get, you can still fail and fail big.

40. Failure isn't a bad thing. It's part of the process.

41. Things always go wrong. The only way to keep that from hurting you is to plan for that.

42. Learn how to respectfully, but firmly, say "no."

43. Say "yes" as much as you can.

44. In order to say "yes" often, attach boundaries or a scope of work around your "yes."

45. No matter how rich, famous, or successful another person is, inside that person is just a human being with hopes, dreams, and fears, the same as you.

46. Getting what you want doesn't mean you'll be happy. Happiness is the art of being satisfied with what you already have.

47. Working with difficult personalities will be a part of every job. Be respectful, do your job well, and nine times out of 10 that person will move on.

48. For that one-out-of-10 time, remember you aren't a victim. Do what you need to get a new job.

49. As soon as you have something to demonstrate, get an executive champion to back or support your project.

50. Focus on what you want, not what you don't want.

Why it is called "cloud"

Taken from BusinessInsider 's article

Why ‘cloud computing’ is called ‘cloud computing’

by MATT WEINBERGER

Rewind to the early nineties: Computer scientists and engineers needed some way in their diagrams and slideshows to refer to “the network,” that big grouping of computers and storage devices out there somewhere. In other words, they needed some way to refer to something that was, essentially, somebody else’s problem.

They settled on a cloud.

You can see one of the earliest uses of that idea in this diagram from US Patent 5,485,455, “Network having secure fast packet switching and guaranteed quality of service,” filed in the January of 1994.

If you squint, that “Network” bubble is cloud-like. The patent’s authors just meant to illustrate that what was in the network wasn’t important for their purposes.

By the time US Patent 5,790,548, “Universal access multimedia data network,” was filed for in the April of 1996, the cloud looked a lot more like a cloud:

It’s just meant to be a vague description of things happening elsewhere.

This usage led to the growing popularity of the term “cloud computing” to refer to servers, networks, and data centers that were located or managed elsewhere and thusly someone else’s problem. A Compaq document from 1996 was probably the first time the term was used in any kind of official capacity, reports the Technology Review. But the term really caught on when Amazon Web Services launched its Elastic Compute Cloud (EC2) in 2006.

Amazon EC2 basically sells virtual servers to other companies — the very definition of “somebody else’s problem.” Other companies caught on and started offering software (like Salesforce), storage (like Box), or a mix of the two (like Microsoft Office 365) from their own data centers to companies who don’t really care where it comes from. To them, the cloud providers are their own squiggly lines on a diagram.

Thursday, March 12, 2015

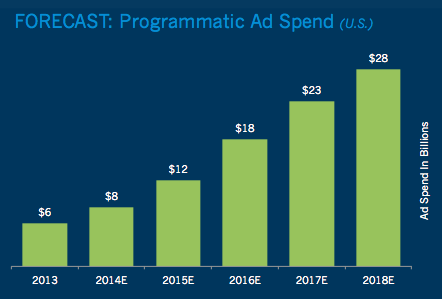

What is Programmatic Advertising

WTF is programmatic advertising?

Wednesday, March 11, 2015

Telecom's e-commerce in Indonesia

Telcom firms build up e-commerce outlets

Driven by a huge market potential and hundreds of millions of Internet users in the country, domestic telecommunications operators are getting more serious about developing their e-commerce businesses.Three major telecommunication operators PT Telekomunikasi Indonesia (Telkom), PT XL Axiata and PT Indosat have allocated some amount of investment this year to revamp their e-commerce businesses.

XL

Through its financial report, XL disclosed that on Jan. 27, it poured US$12.1 million into Elevenia (www. elevenia.co.id), its e-commerce outlet. That investment was equal to the amount invested in the marketplace by its partner SK Planet, a subsidiary of South Korean SK Telecom."The additional investment was part of Elevenia's blueprint that has been agreed upon by both XL and SK Planet," said Elevenia chief financial officer Lila Nirmandari.

Both business partners open the possibility of adding more fresh capital to the marketplace in the coming months, depending on the market dynamic, she told The Jakarta Post.

Lila said most of the $24.2 million investment would be used to support sales and promotion activities to make Elevenia known better outside Greater Jakarta.

Officially launched in March last year, Elevenia was first established in mid-2013 with initial investments of $18.3 million from XL and another $18.3 million from SK Planet, giving each of them a 50 percent of stake.

As of February, Elevenia had around 20,000 merchants and 2 million products comprising eight categories: fashion, beauty & health, babies & kids, home or garden, gadget, electronics, sports or hobby and service or food.

Elevenia aimed to increase its revenue by four to five times this year compared to its revenue of Rp 3.5 billion ($267,500) last year, leveraging on XL's surging data subscribers.

Last year alone, around 51 percent of XL's 59.6 million subscribers (including postpaid users) were data users.

Indosat

Separately, Indosat also aims to boost. its e-commerce outlet Cipika (www.cipika.co.id), which is run by the company's digital commerce division.Taking a bolder stance to differentiate it self from other marketplaces, Cipika plans to change its product focus from local food and snacks to gadgets this year.

"Focusing on gadget and electronics [this year], we want to leverage on Indosat's core products and core networks," said Indosat's head of digital commerce division, Carlos Karo Karo. As of September last year, Indosat had 54.2 million subscribers, of whom around 50 percent were data users.

Cipika would sell phones bundled with Indosat's mobile packages as well as phones bundled with competitors mobile packages, Carlos said.

In the span of November 2014 te January this year, gadgets contributed to around 30 percent of transactions in Cipika, while food and snacks remained a major contributor, he added.

In 2014, food and snacks contributed to around 80 percent of transactions in Cipika, while the remaining 20 percent was from another three product categories: gadgets, travel and lifestyle.

"This year, we hope 80 percent of the transactions will be from gadgets," Carlos told the Post.

Carlos refused to disclose how much Indosat would invest for Cipika this year to support its marketplace , business transformation, but said that an investment fund dedicated to the development of the marketplace was already in place.

Indosat usually spends between Rp 7 and 8 trillion in its annual capital expenditure, part of which is allotted for its digital service.

Carlos said Indosat would continue investing in its digital service in the future as it had still an ample room to grow.

Only around 1.7 percent of transactions in Indonesia's market were currently done online and it was forecast to increase to 7 percent by 2019, he said.

"Cipika aims to cater between 17 and 20 percent of those online transactions in 2019," he went on.

Telkom

Meanwhile Blanja (www.blanja.com), a marketplace jointly run by state-owned telecommunications firm Telkom and US-based marketplace giant eBay, does not target specific growth rate this year but foresees a huge potential.Telkom, which netted around 138 million subscribers as of September last year, and eBay initially established PT Metra Plasa with a total investment of $14.2 million in April 2012 to make a joint e-commerce marketplace. It later developed into today's Blanja.

Officially launched in December last year, Blanja currently has around 80,000 page visits per day and almost 500,000 registered customers, said Blanja CEO Aulia Marinto.

"Let's not forget that the e-commerce industry is still quite new and there is ample room to grow as Internet penetration gets better and the economy keeps growing," he added.

UBS has projected that Indonesia's Internet penetration will hit 55 percent in 2017, meaning that there will be around 130 million people having access to the Internet.

However, while the potential is huge, challenges for e-commerce remain at logistic, payment gateways and regulation certainty, according to the three telecommunications operators.

Blanja's Aulia said e-commerce very much depended on external factors that could become enablers, such as logistics services and payment methods.

Communications and Information Minister Rudiantara said recently that the government planned to issue an "e-commerce roadmap" in the next three to six months to provide clear guidelines on logistics services, payment gateways and taxes for the e-commerce industry.